Project details

How it works:

AI in Finance Automation Tool

Streamlining Purchase Orders, Workflows, and Financial Operations Through Intelligent Automation

The Solution:

AI-Driven Financial Workflow Automation

The BigAI Agent for Finance introduces intelligent automation into complex financial workflows, combining conversational interfaces with cognitive decision-making.

The tool manages end-to-end processes including:

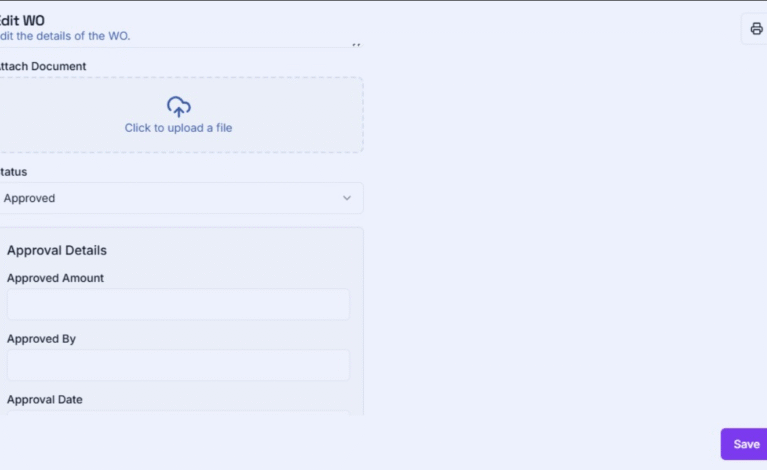

- Purchase Orders (PO) and Work Orders with AI-based initiation, validation, and hierarchical routing.

- Vendor onboarding and management, including communication, verification, and automated reminders.

- Receivables and payables tracking with real-time status updates and reconciliation support.

- Bill generation, submission, and approval, handled through structured, multi-level acknowledgment.

- Smart alerts, reminders, and escalation management, ensuring timely actions across departments.

- Automated report generation and AI insights, enabling financial risk monitoring, fraud detection, and audit readiness.

The result is a fully connected, transparent, and intelligent finance ecosystem that minimizes human dependency while ensuring precision and compliance.

Loss Function:This function measures the difference between the network’s output and the actual target. Common loss functions include Mean Squared Error (for regression tasks) and Cross-Entropy Loss (for classification tasks). This is the method used to update the weights.

Our challange:

Financial departments often face operational bottlenecks due to manual, fragmented processes.

Prior to automation, organizations struggled with:

- Delayed Purchase Order and Work Order approvals due to multi-level hierarchy and manual tracking.

- High dependency on human coordination leading to missed follow-ups and lost documentation.

- Manual data entry and reconciliation errors, impacting accuracy and compliance.

- Unstructured vendor communication, making accountability and payment tracking difficult.

- Slow approval cycles caused by repeated verification and non-transparent workflows.

- Limited visibility into financial risk and audit readiness, resulting in compliance inefficiencies.

These issues led to financial delays, reduced transparency, and inconsistent control over approvals and payments.

Achievement:

- Reduced PO and Work Order Processing Time by 70%

Automated approval routing and verification reduced turnaround time significantly. - Enabled Real-Time Financial Visibility

Centralized dashboards offer instant access to PO status, vendor balances, and transaction histories. - Enhanced Accuracy and Compliance

AI validation ensures error-free data entries, invoice checks, and ledger updates. - Streamlined Vendor Communication

Automated follow-ups and acknowledgment improved vendor relationships and accountability. - Optimized Hierarchical Approvals

Multi-level authorization ensures proper oversight with traceable decision logs. - Improved Receivables and Payment Cycles

Predictive reminders and analytics improved payment efficiency and reduced outstanding receivables. - Audit-Ready Reports and AI Insights

Automated reporting with AI-driven insights supports risk assessment, compliance audits, and management reviews.

Value Propositions

1. End-to-End Finance Automation

Complete automation of PO, Work Orders, and approval chains saves administrative hours and reduces operational costs.

2. Context-Aware Decision Intelligence

AI identifies financial anomalies, risk patterns, and approval inconsistencies to enhance decision accuracy.

3. Seamless ERP Integration

Connects natively with SAP, Tally, QuickBooks, and Zoho Books to synchronize data in real time.

4. Hierarchical Workflow Routing

Dynamic approval chains ensure requests reach the right authority automatically.

5. Transparent Audit Trails and Reporting

Every action is logged with time-stamped records and AI-generated summaries, ensuring full traceability for compliance.

6. AI-Powered Risk Management and Insights

Predictive analytics highlight irregularities, vendor performance issues, and approval delays, helping teams mitigate financial and operational risks.

7. Scalable, Secure, and Configurable

Supports large organizations with multi-level hierarchies, ensuring scalability without compromising data security.

The BigAI Advantage

BigAI Agent’s Finance Automation leverages Agentic AI to deliver adaptive, context-driven, and compliant workflows.

It not only automates routine financial operations but also provides actionable insights for continuous improvement and risk management.

This turns finance teams from process executors into strategic enablers—empowered by intelligent automation, audit-ready data, and AI foresight.